БИЗНЕС В ОАЭ

Успех Ваших Решений

Наш подход к работе имеет комплексный характер, конечно можно с ходу дать консультацию, однако если правильно получить информацию от клиента, то и дальнейшие наши действия приведут Вас к желаемому результату. Пишите и звоните, если есть вопросы по бизнесу в ОАЭ. Мы рады Вам помочь.

2. Ликвидация компаний;

3. Администрирование и поддержка деятельности компании;

4. Открытие банковских счетов;

5. Организация бухгалтерских, аудиторских услуг для компаний;

6. Регистрация торговых марок и патентов;

7. Продление лицензий;

8. Продление резидентских виз для владельцев и их семей;

9. Импорт и экспорт товаров и необходимые таможенные документы;

10. Заверение и легализация корпоративных и личных документов;

11. Предоставление договоров аренды (коммерческих и индивидуальных);

12. Услуги наших партнерских компаний юристов, адвокатов, аудиторов;

13. Разрешение сложных финансовых, социальных, административных ситуаций в ОАЭ;

Информация о компаниях

Общество с ограниченной ответственностью (ООО) Limited Liability Company (LLC)

Регистрация компаний в ОАЭ в форме общества с ограниченной ответственностью не требуется при участии партнера — гражданина ОАЭ. Для регистрации общества с ограниченной ответственностью достаточно копии паспортов учредителей, а остальные документы оформляются на месте в процессе регистрации.

Learn More

Свободные экономические зоны (СЭЗ)

В ОАЭ успешно функционируют более 45 свободных экономических зон, в которых допускается 100% иностранное владение и не требуется привлечение местного партнера. Мы поддерживаем открытие компаний свободных экономических зон в ОАЭ. Свободные экономические зоны ОАЭ предоставляют выгодные условия для иностранных инвесторов, с возможностью открытия компаний с иностранным капиталом, снижают налоговую нагрузку, имеют льготы при совершении таможенных операций. Также в свободной зоне возможно открытие представительства или филиала.

Learn More

Филиал/Представительство иностранной компании в ОАЭ.

Условия открытия такой компании аналогичны вышеназванной Профессиональной компании в ОАЭ, а именно: 100% владение иностранным инвестором и наличие сервисного агента — гражданина ОАЭ. Филиал/представительство иностранной компании не имеет права вести коммерческую деятельность на территории ОАЭ, по этой причине все соглашения и договоры заключаются исключительно от имени головного офиса (материнской компании). Количество сотрудников ограничено. Все три типа собственности компании не требуют прохождения аудита.

Learn More

Банковский счет

Банки в Объединенных Арабских Эмиратах Банки в ОАЭ делятся на две основные категории: местные зарегистрированные банки и акционерные общества, имеющие лицензию в соответствии с положениями Закона № 10 ОАЭ от 1980 года, и филиалы иностранных банков, получившие лицензии Центрального банка на осуществление банковской деятельности на территории страны в соответствии с положениями указанного Закона. Банки ОАЭ стабильны и надежны. Репутация банков ОАЭ привлекает бизнесменов со всего мира. Тарифы на банковское обслуживание приемлемы и действуют по упрощенной схеме отчетности. Как правило, банки ОАЭ интересуются только происхождением средств, поступающих на счет в особо крупных размерах из ранее неизвестных источников. В этом случае достаточно будет предоставить копию договора, на основании которого переводятся средства.

Learn More

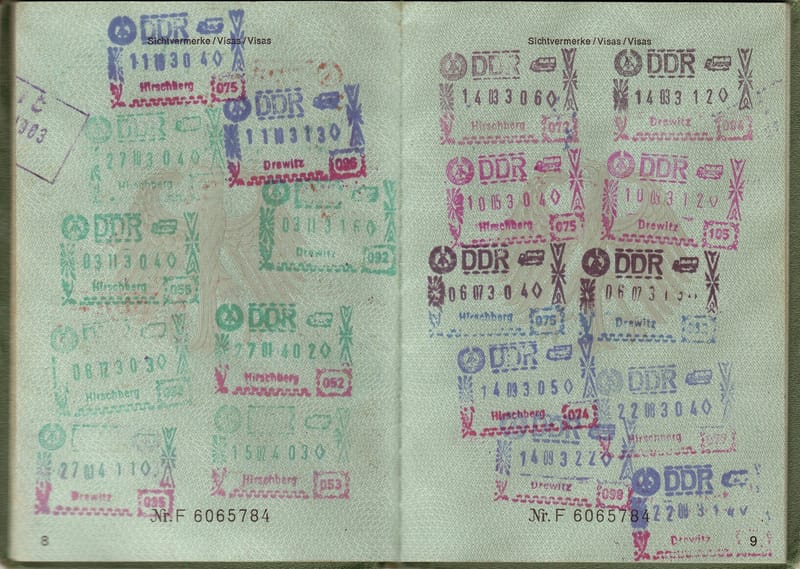

Визы

Для нерезидентов ОАЭ, находящихся в стране, требуется виза, которая оформляется заранее или выдается при въезде в страну. Для коммерческой деятельности в ОАЭ требуется резидентская виза от организации.

Learn MoreКонтакты

- Dubai, United Arab Emirates